Value Creation – Assessment

First step on the journey to transfer a business is always a valuation. Valuating a company is a complex task. Many different methods such as the discounted cash flow method (DCF) or the enterprise value method (EV) as well as applying the income, asset and/or market approach are only a few to mention. At the end, it is the meeting of the mind of two parties that agree on a price to be paid for a company will be the result of a successful transaction.

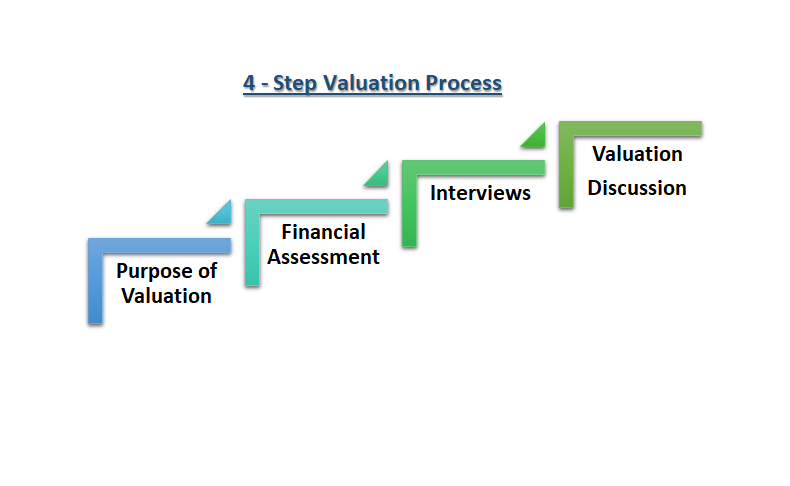

Lehmann & Partner International have performed many business valuations and developed a 4 – step valuation process that not only leads to a value of the business itself but also points out areas for improvement. Business values can often be increased and can lead to twice the value and sometimes even more.

Our 4 – Step Valuation process:

- Determination of the purpose of the valuation (family succession, selling to a third party, etc….)

- Gathering all necessary financial information such as tax returns, P&L, and other.

- Interviews to cover areas like:

- Financials

- Customers

- Process, Procedures

- Employees

- Company Culture

- Valuation Results and Discussion

Valuation Discussion and Reality Check

The last step is the most important one it represents the current value and shows the probability to what price a company can be sold on the market. Only an experienced M&A adviser will be able to tell if a company can be sold below and or above value. It’s a waste of everyone’s time to take a company to market with unrealistic value expectations.

Lehmann & Partner International only objective is to give our clients a range of value that we feel confident of hitting with the odds in the 80%-90% range. If the gap between what you want for your business and what we can get you is above our range of value by too great a margin, we will advise not taking the company to market at this time. We will, instead, suggest ways to improve the business. In the USA only 20% of all companies that are on the market for sale are successful with a transition. In order to conduct a comprehensive valuation we cover many business areas as shown below:

So, what do we look for in a company to determine value?

- Customer base

- Products and services

- Market share

- Growth opportunities

- Management and employees

- Financials / Gross Margins

- Sales and recast EBITDA history and outlook

- Ownership structure and motivation

- Technology applied in the company

- Facility and equipment

- Quality of earnings (Q of E).

“The future belongs to those who see possibilities before they become obvious.”

Value Creation

Get Market & Business Intelligence Delivered!